-

Modules

Modules

Free Trial

Would you like to try ZEOPS for free?

Click on the link and start using the human resources management system specific to your business.

Basic Modules

Basic Modules Additional Modules

Additional Modules

-

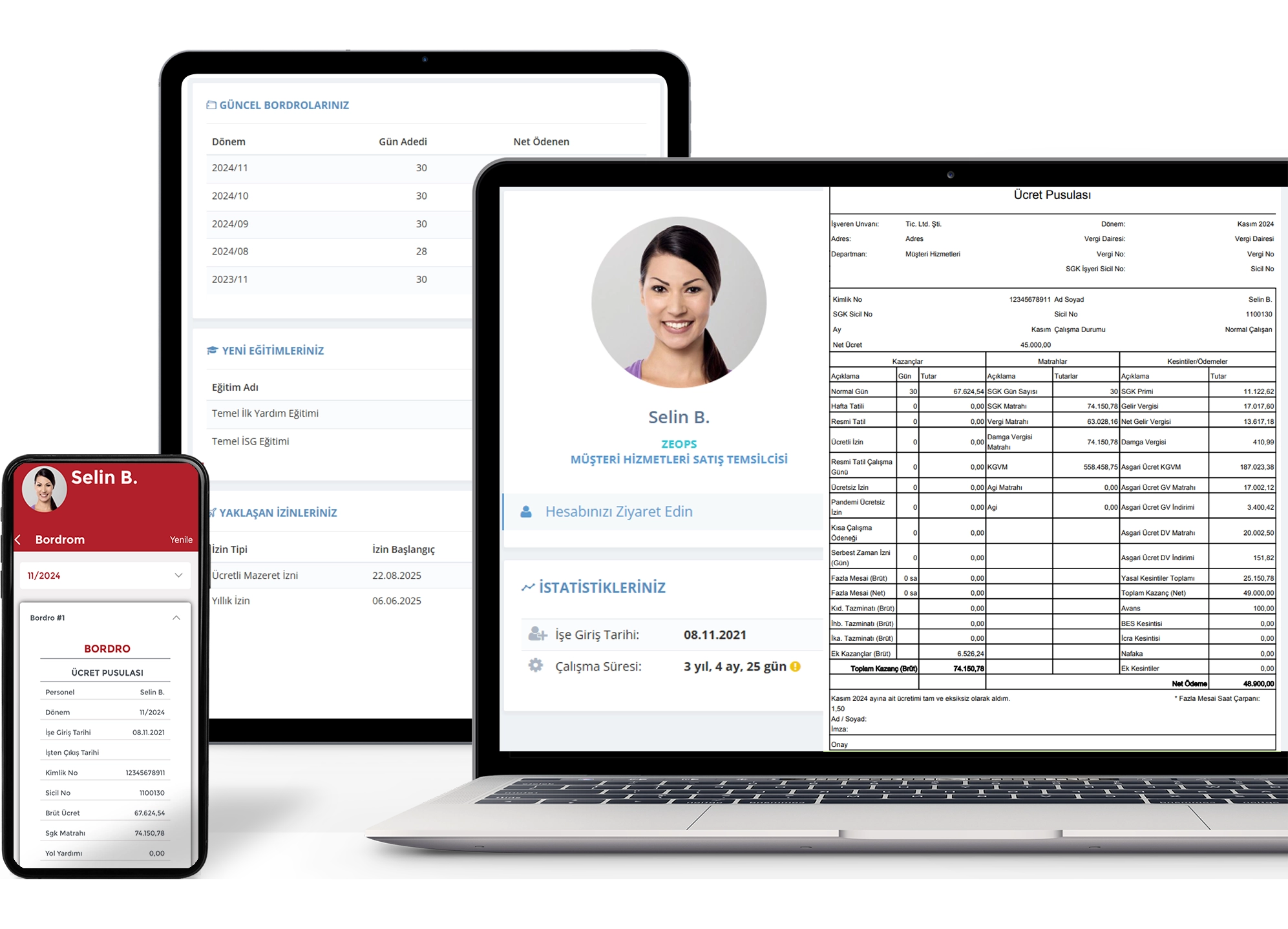

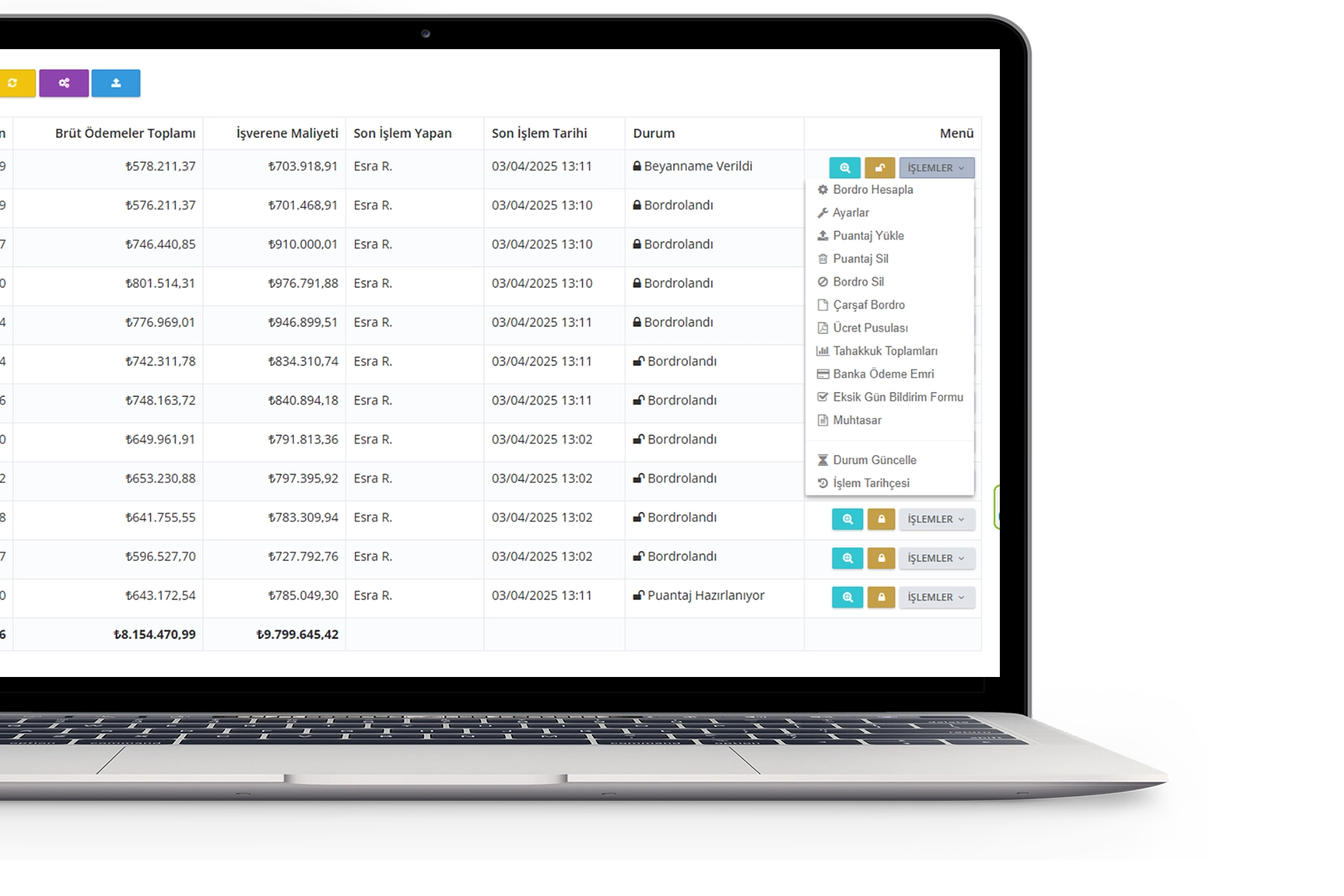

Payroll Management

Fast and practical payroll with Zeops Payroll Management

-

Shift Management

Share the shift plan with your employees with one click

-

Performance Management

Evaluate based on either competence or goal

-

Remote Training Management

Remove distances in training

-

Task Management

Continuous communication with Zeops Task Management

-

ORIS

On-site and timely follow-up with Zeops Oris

-

Form Management

Say goodbye to paper materials with Zeops Form Management

-

Expense Management

Controlled management of expense tracking

-

Survey Management

Continuity in employee satisfaction with Zeops Survey Management

-

Payroll Mirroring

Solution without integration with Zeops payroll mirroring feature

-

Timestamp

TÜBİTAK approved Time Stamp in accordance with Law No. 5070

-

- About Us

- Contact